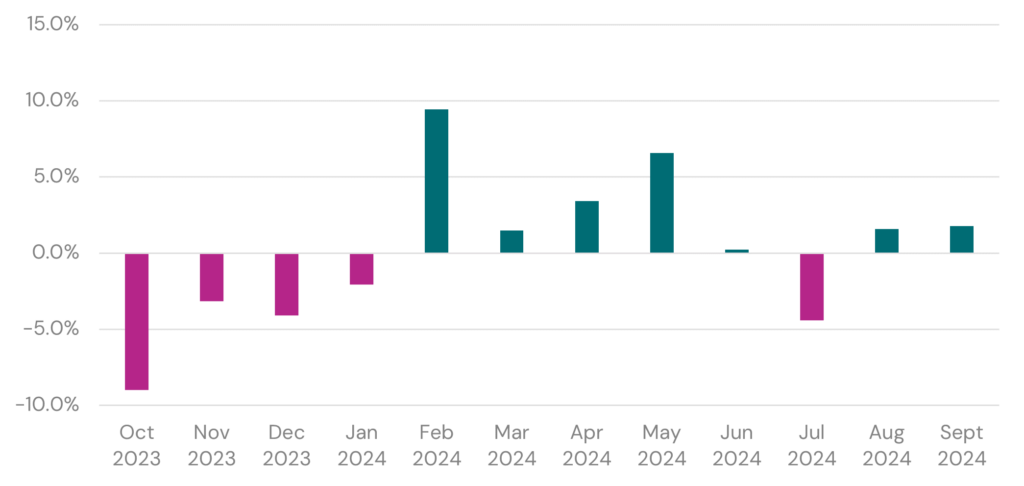

Consumer spending this September was down -5.3% from September last year. This marks the fourth consecutive month with a decline in spending, and the worst even. The latest drop in OCR was a move in the right direction, but certainly not something felt in our pockets just yet.

Key insights for September 2024

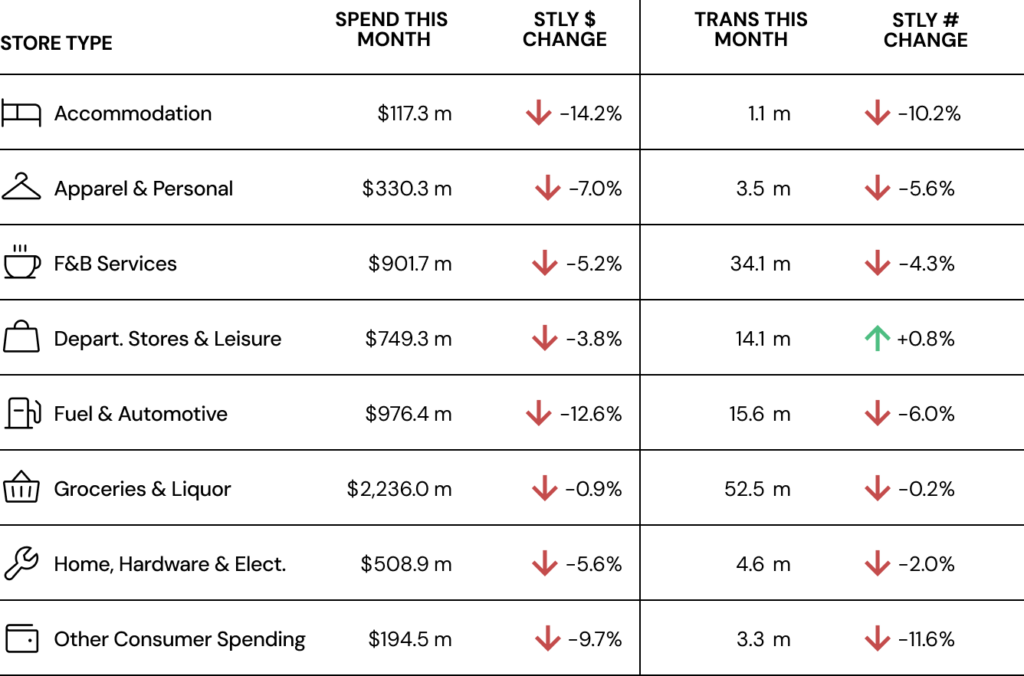

- Consumer spending dropped -5.3% and transaction volumes dropped -2.6% when compared to September 2023.

- Every storetype experienced a drop in spending, with Groceries & Liquor reporting the lowest drop in spend, down -0.9%.

- Every region also experienced a drop in spending, with Nelson Region registering the lowest drop in spend, down -1.5%.

- Compared to September 2019 (pre-pandemic), consumer spending was up 17.7%.

Hospitality in the Big Smoke

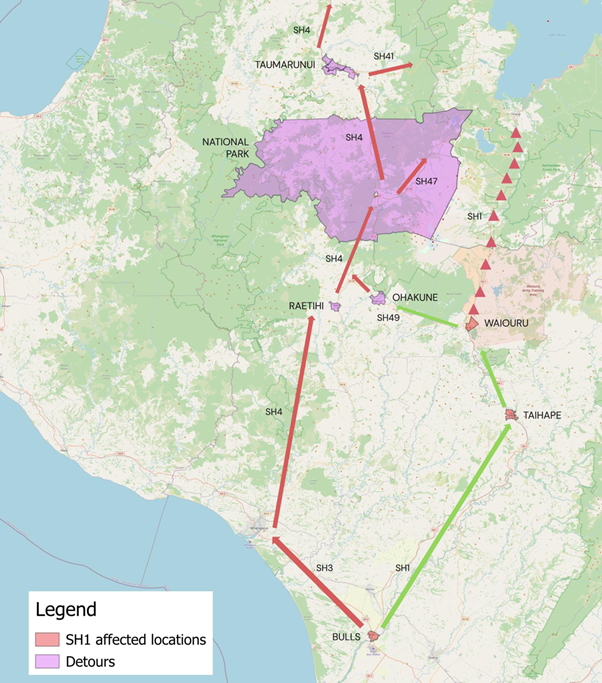

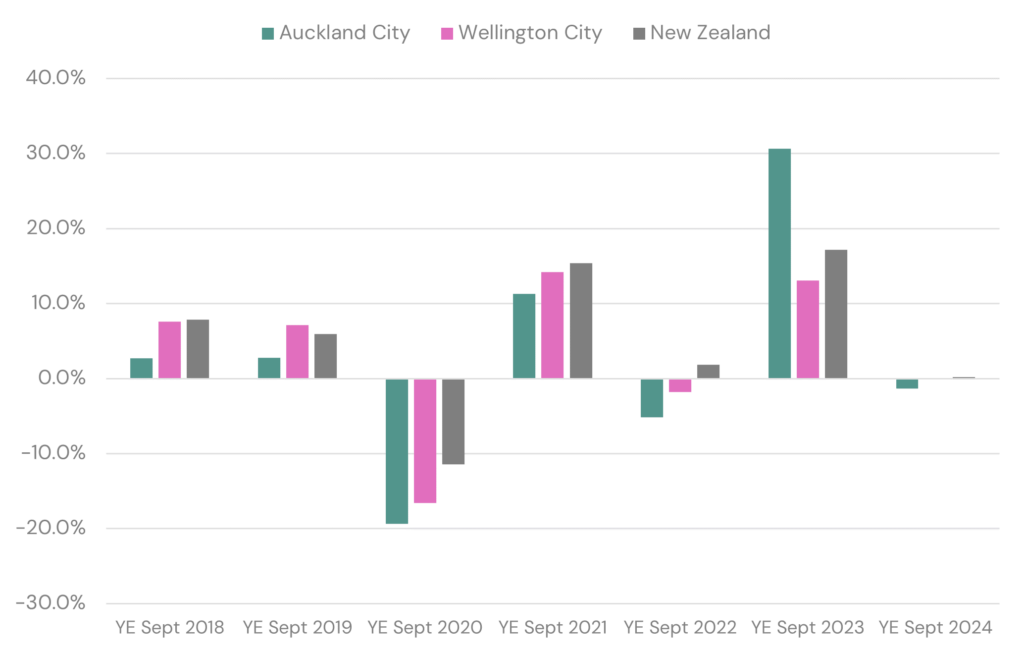

Hospitality, which we take to mean Cafes, Restaurants, Bars and Takeaways, was front and centre of the media during the pandemic. Post-pandemic, they continue to be in the media. Initially as a result of labour shortages, and now the cost-of-living crisis (with its double whammy hit on both supplier prices and consumers’ wallets), that too many are working from home, and the poorly timed construction work in cities like Auckland and Wellington (refer to Figure 1).

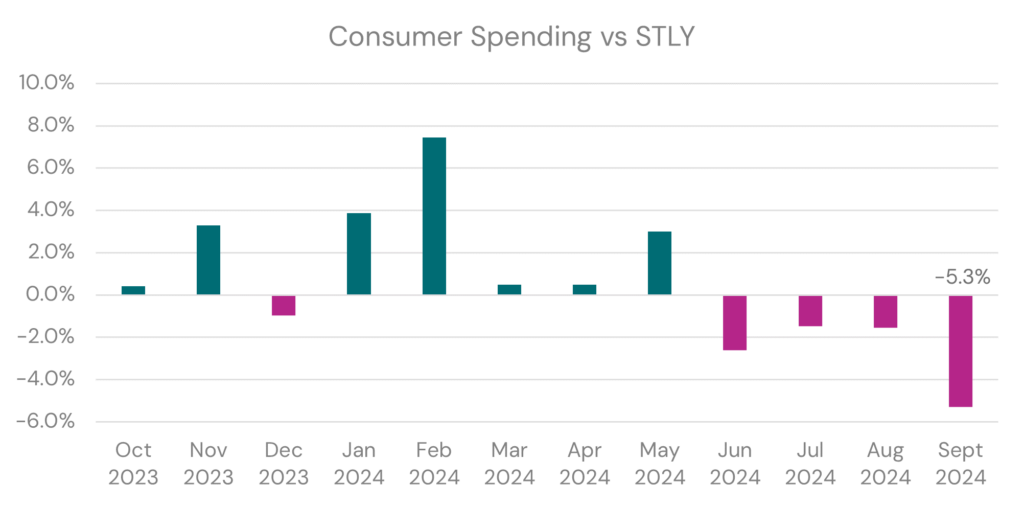

Figure 1: Comparison of % change in spend on Hospitality in Auckland and Wellington Cities vs New Zealand.

Spend on Hospitality in New Zealand this September vs last September dropped -5.2%, a validation of an industry that’s continuing to struggle. However, when we review it over the last 12 months, it doesn’t look quite as dire, with spend on Hospitality up +0.2%.

Spend on Hospitality in Wellington grew by +1.8% when comparing month to month, and grew a marginal +0.1% when comparing year to year. We have read of many hospitality store closures in recent weeks, and some of them heartbreaking, as they were such stalwarts of the Wellington food scene. Given the ability of the sector to breakeven over the last 12 months (refer to Figure 2), suggests there is still enough demand to keep the sector going. Unfortunately, this doesn’t translate equally to every operator. That some businesses are more susceptible to a downturn than others requires a more specific investigation into what of its location or demographic or business efficiencies that are driving its fate.

Figure 2: % change in spend on Hospitality in Wellington City.