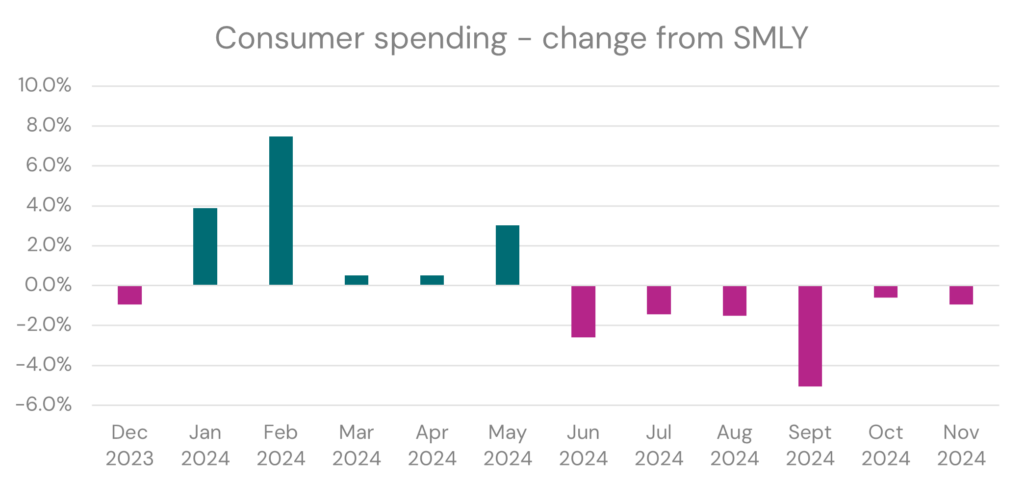

Consumer spending was down 0.9% in November. This is New Zealand’s 6th consecutive month in decline when compared to the same month last year. Over the last 12 months, we have barely made it out of the red, with YE November 2024 spend up a mere 0.1%.

Key insights for November 2024

• Consumer spending dropped -0.9% but transaction volumes increased +0.8% when compared to November 2023.

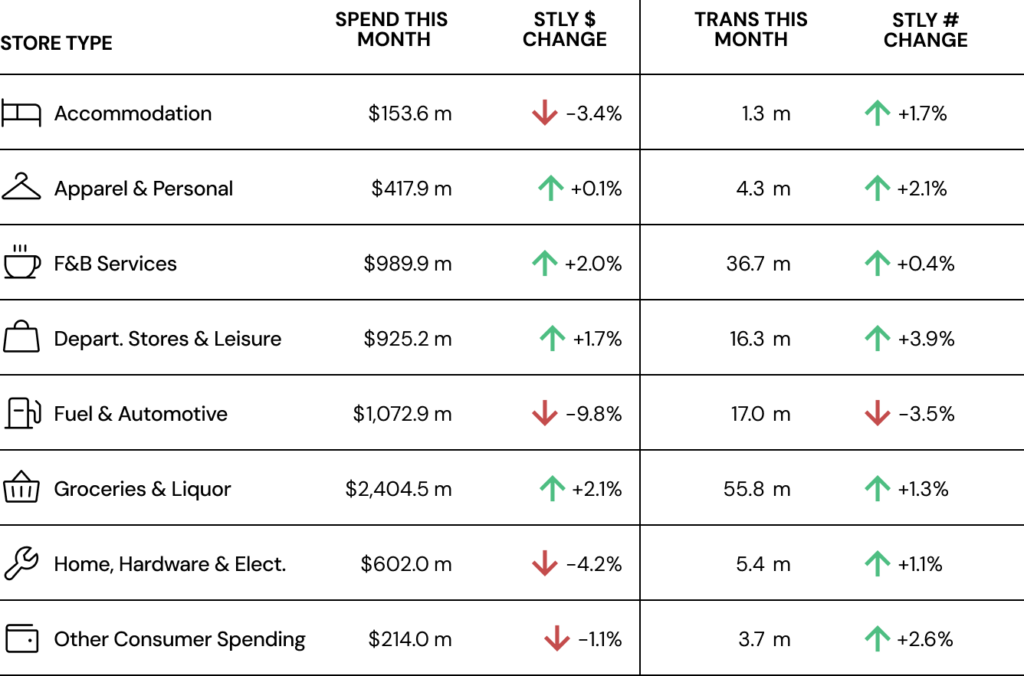

• In a case of déjà vu, Groceries & Liquor are back on top again, for generating the highest change in spend this month, up +2.1%.

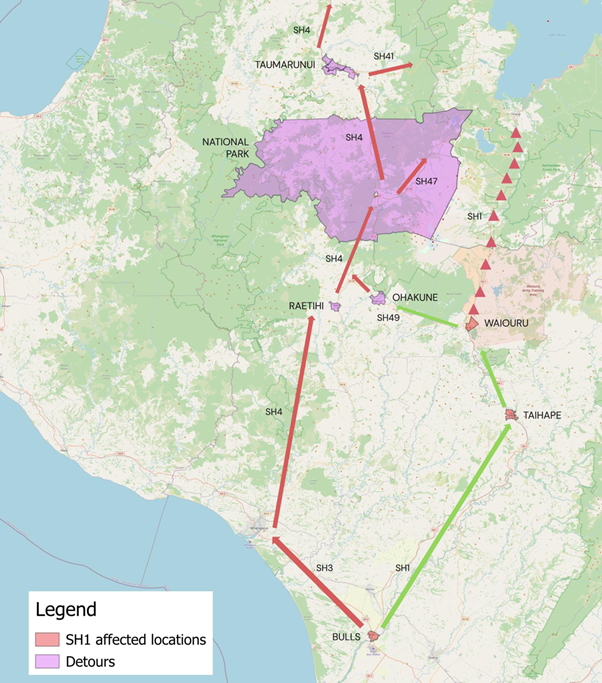

• Nice to see Gisborne topping the regions for highest growth in spend this month, up +1.9%, after their weather woes earlier this year.

• Compared to November 2019 (pre-pandemic), consumer spending was up 17.8%.

This month Groceries & Liquor led the way, with spend up 2.1%. With the start of the peak tourism season, F&B Services tracked closely behind, with 2.0% growth. In October, we saw spend rise uncharacteristically in Apparel & Personal (+4.0%). We had hoped that with Black Friday a key feature of November, that it would signal a change in the tides. Unfortunately, Apparel & Personal and some of the other ‘traditional retail’ storetypes did not see the scale of increases in spending we’d anticipated this month.

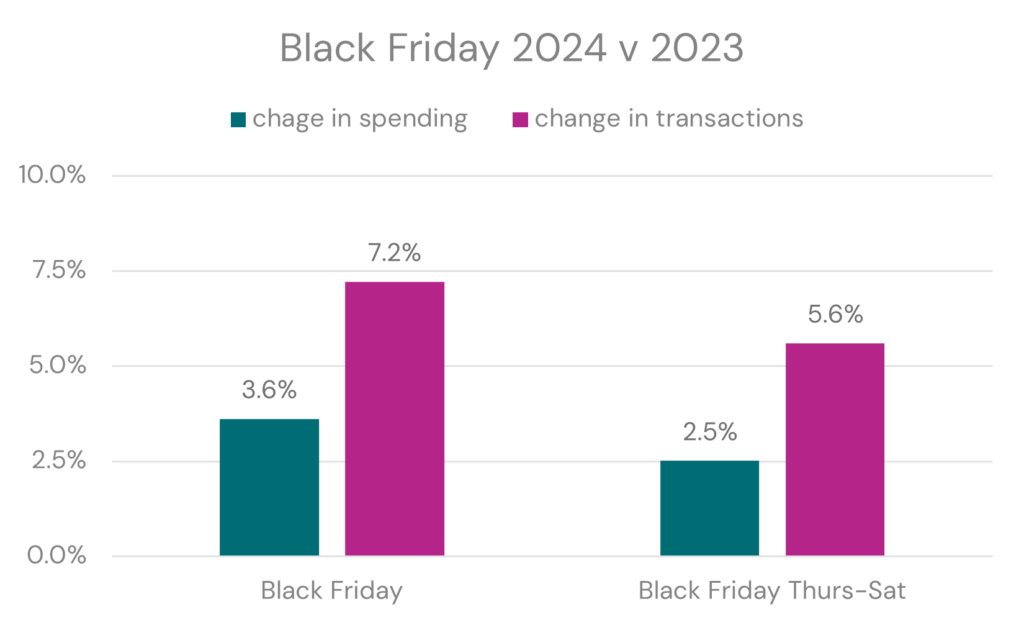

Black Friday

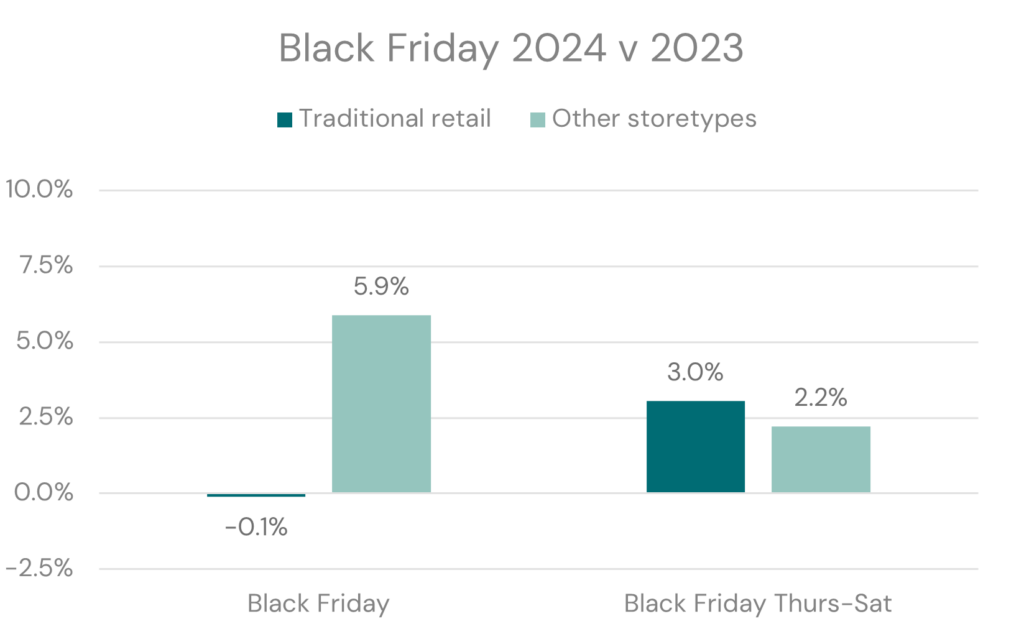

The extended Black Friday period has become a key period for many retailers, as many consumers wait for this retail event to get discounted goods for themselves, and or to get a head start on Christmas. While Black Friday itself, and the dates either side, had a decent result it was quite likely not the result many retailers were hoping for.

Spend over Black Friday was up 3.6%. However, when interrogating these figures further, much of the growth was driven by ‘essentials’ (Groceries and Fuel) as opposed to what we would have expected on ‘traditional retail’ such as electronics, homeware, clothing and shoes, etc.

The change in transactions was also much higher than the change in spend, which tells us that people may be spending, but they were spending much less per transaction.

Over the last few years, Black Friday had outpaced Boxing Day in spend on traditional retail. Given this year’s lacklustre Black Friday, it will be interesting to see if consumers will remain disciplined about their discretionary spending with the Boxing Day sales to come.

International Tourism

New Zealand is warming up and with that comes more of our international visitors. This month, international spending rose 12.4% over our measured storetypes. Provision international visitor arrivals as reported by Stats NZ in the four weeks to 24 November 2024 saw a comparatively smaller increase at 3% when compared to the four weeks to 26 November 2023.

That international visitor spend supersedes that of arrivals many times over potentially reflects our high cost of living, or a willingness to spend given it may be a trip of a lifetime, or more affluent visitors. Regardless, increased charges such as the IVL (International Visitor Conservation and Tourism Levy) from $35 to $100, will cement New Zealand as more of a premium visitor destination which will no doubt evolve our visitor mix over time.

Auckland City as our largest gateway and only turnaround port, unsurprisingly reaps the lion’s share of international spend, making up 19% of all international spend. Queenstown is our largest tourism drawcard and holds second place with 15% of all international spend. Almost half of all international spend (48%) this month was spent in Auckland City, Queenstown-Lakes District, Christchurch City and Wellington City, reflecting the magnetism and or role these city hubs play in an international itinerary. As the country warms up and more visitors arrive, one hopes the international wallet will extend throughout the country a whole heap more.