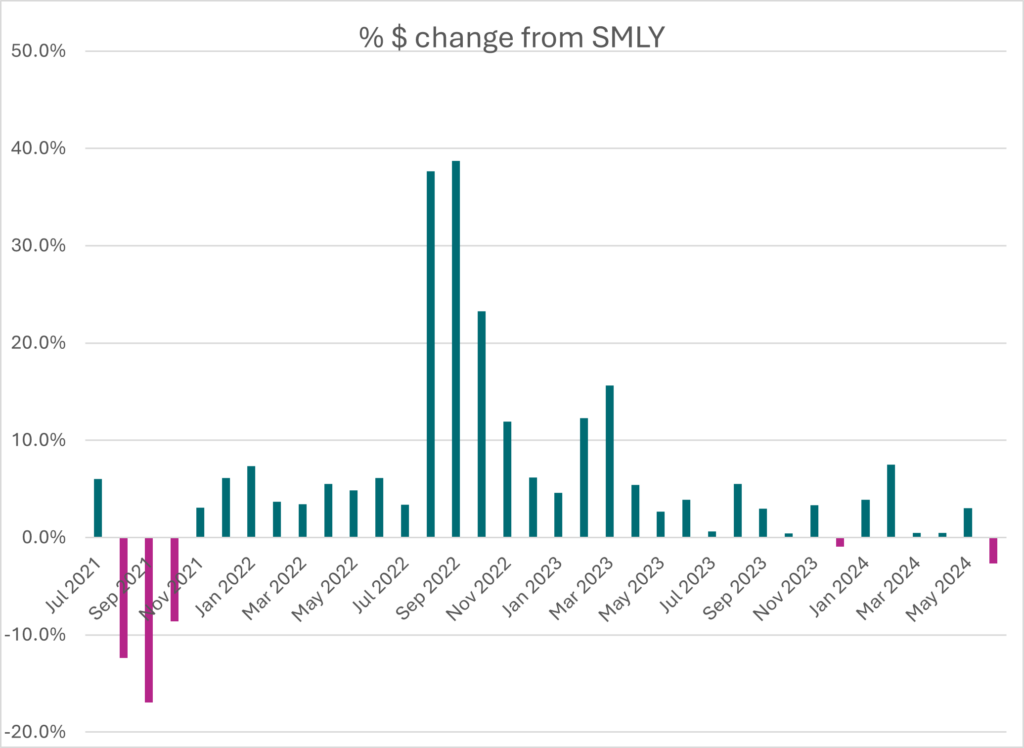

With the exception of December 2023, June 2024 is the first time since October 2021 to record a month on month decrease in spend.

• Consumer spending in June 2024 dropped -2.7% from June 2023, and transaction volumes dropped by the same extent, down -2.7%.

• The Wellington Region was the best performing region, with a milder drop of -0.6%; and where Nelson saw the greatest drop, down -6.7%.

• Groceries & Liquor was the highest performing storetype at 1.8% increase.

• Consumer spending in June 2024 was up 17.9% on June 2019 (pre-pandemic).

Ignoring December 2023, which dropped -1.0% when compared to December 2022 (the highest December ever over the last 4 years), June 2024 is the first time since October 2021 to record a month on month decrease in spend (as seen in the chart below).

Spend dropped -2.7% when compared to June in 2023.

The Wellington Region was the best performing region, with the lowest drop of -0.6%. That the ‘highest performing region’ this month is a negative figure, reflects the state of the economy.

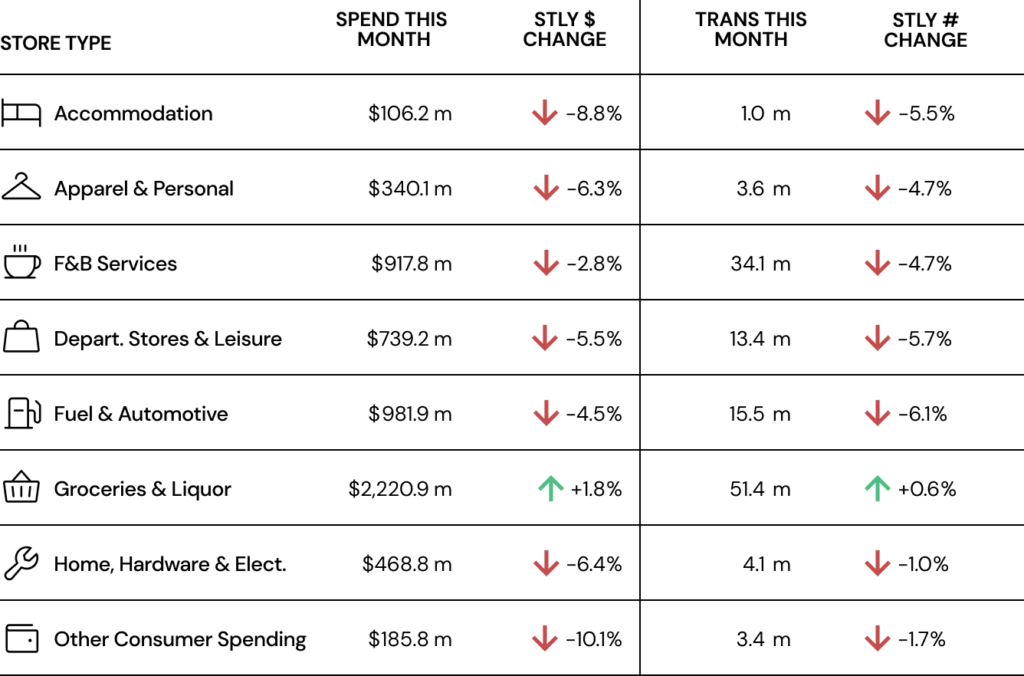

Breakdown by storetype further validates this contracting climate, with spend increase only evidenced in Groceries & Liquor (1.8%), and a mild increase at that, on what is an essential spend. Every other storetype registered significant decreases both in spend and transactions (as seen in the table below).

June gave us two public holidays – King’s Birthday and Matariki. Even though those long weekends provided the opportunity for a short getaway, both holidays registered a drop in spend when compared to the same holiday weekends in 2023.

Spend over King’s Birthday was down -0.7% from the same holiday period in 2023; and spend over Matariki was down -2.9% over the same holiday period in July 2023.

The following section provides a bit more insight into Matariki.

Matariki 2024

Matariki celebrated its 3rd anniversary as a statutory holiday this year. While this weekend is more about celebrating the Maori new year by spending time with friends and family, we take a look at people’s behaviours through their spend this long weekend.

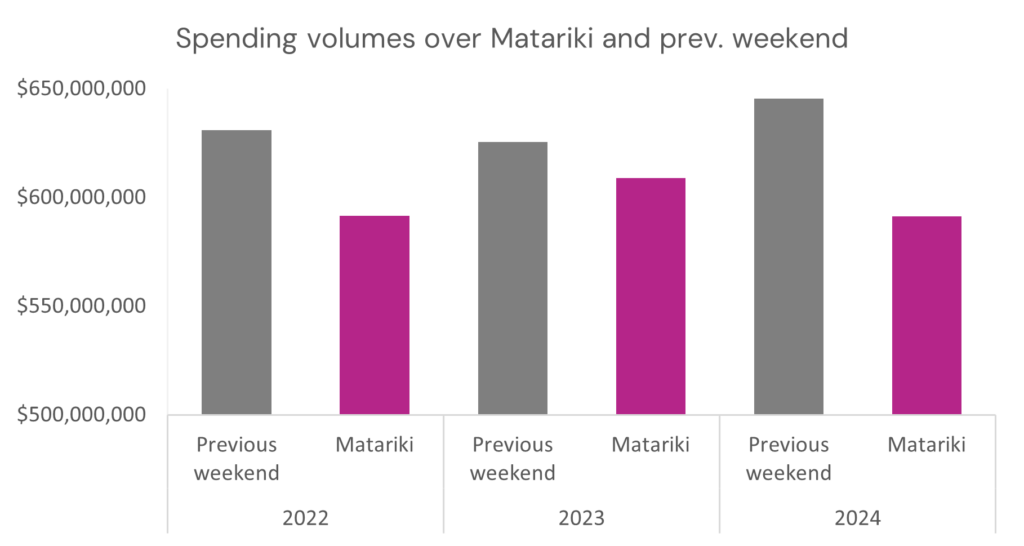

As it turns out, the Matariki weekend was soft for most retailers. Reflecting the challenging economic climate, spending volumes were down 2.9% from the 2023 Matariki weekend and down 0.1% from 2022.

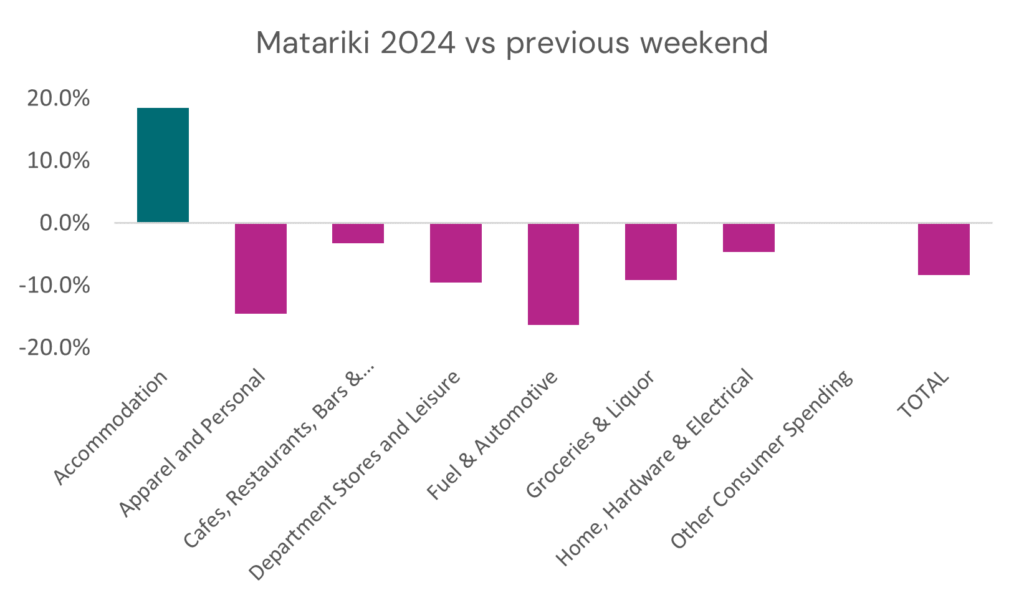

Consumer spending was also down 8.4% on the previous Fri-Sun ‘weekend’. When looking at the trends of the last three years, the weekend prior to Matariki was a more active retail period each year, suggesting that consumers had other plans for the holiday weekend and shifted some retail activity accordingly.

While overall consumer spending was down 8.4% from the previous weekend, the single category that had a strong weekend was the accommodation sector, up 18.4%, further suggesting that Kiwis took the weekend off their usual activities. Within this, the top three regions were Northland (67.7%), Bay of Plenty (54.1%) and Waikato (47.3%).

If your organisation would like to find out more about spending over this weekend, or any other information, please feel free to give us a call for a no-obligation quote.