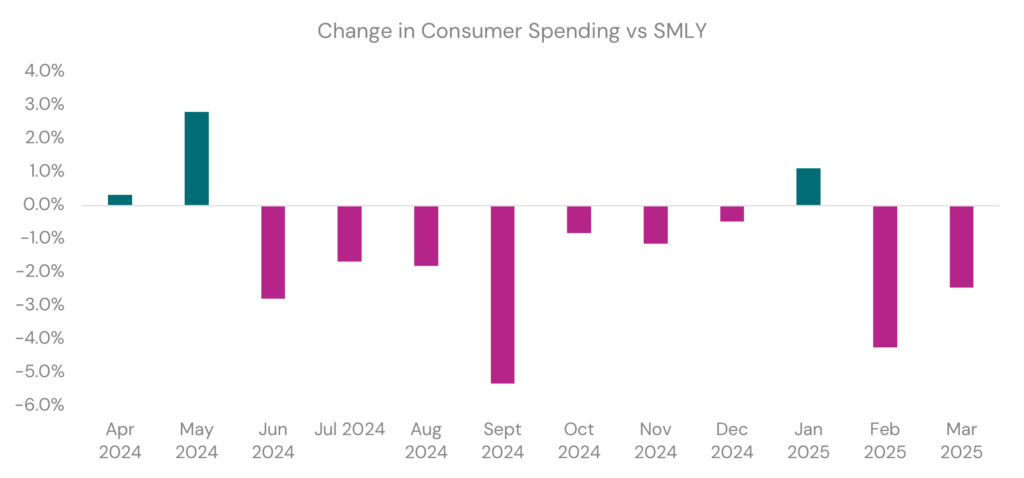

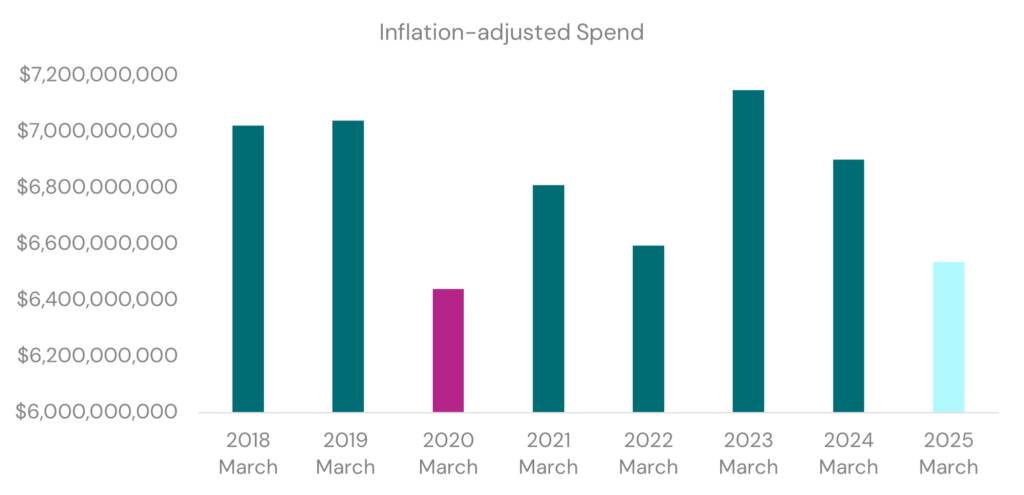

March 2025 continues a decline in consumer spending when compared to the same month last year (SMLY), down -2.5%. Of the last 12 months, only three saw growth. See chart below.

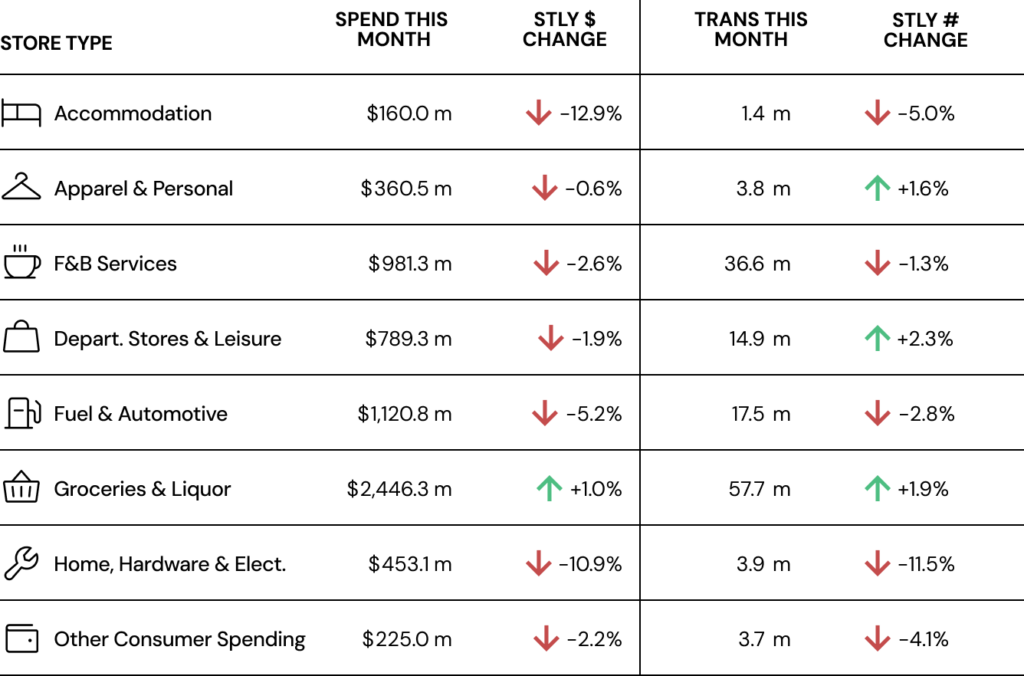

The retail landscape looks bleak. Unless you are a grocer or an off-licensee, which collectively grew +1.0% from the same month last year (Groceries & Liquor), every other storetype was in the red.

Continuing the trend from the last two months, the growth we did experience came from the Internationals who grew spend by +5.2% from March 2024, whereas New Zealanders continue to curtail any un-essential spend, down -3.0%.

Key insights for March 2025

• Consumer spending dropped -2.5%, a lot more than transactions which dropped 0.2%.

• Groceries & Liquor was the only storetype that saw spend grow, up +1.0%.

• Every region saw spend drop, where the least affected was Nelson City, down -0.2%.

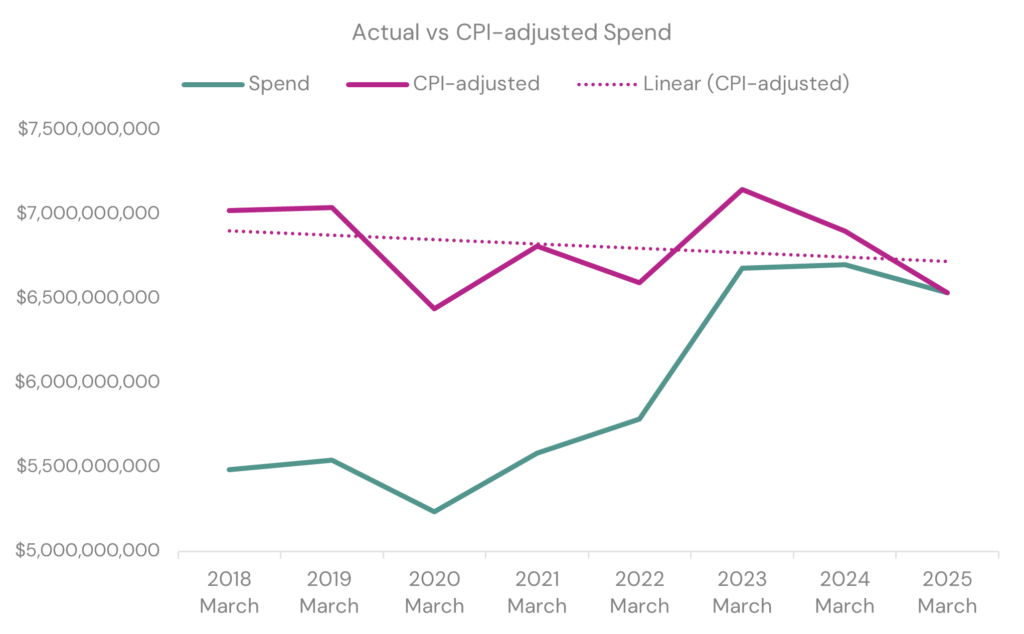

• Compared to March 2019 (pre-pandemic), consumer spending was up +17.9%. However, if we were to apply RBNZ’s inflation calculator to bring March 2019 to today’s value, spend in March 2025 would be down -7.1% in comparison.

A storetype breakdown is detailed below:

Retail Demand Shrinking

In the chart below we have plotted overall consumer spending (teal line) against an inflation-adjusted comparative (plum line). While overall consumer spending has strong growth on pre-Covid times, when adjusted for inflation we see that our net spending has actually dropped. This reflects the tough economic times we are currently in and that our demand on retail is currently shrinking.

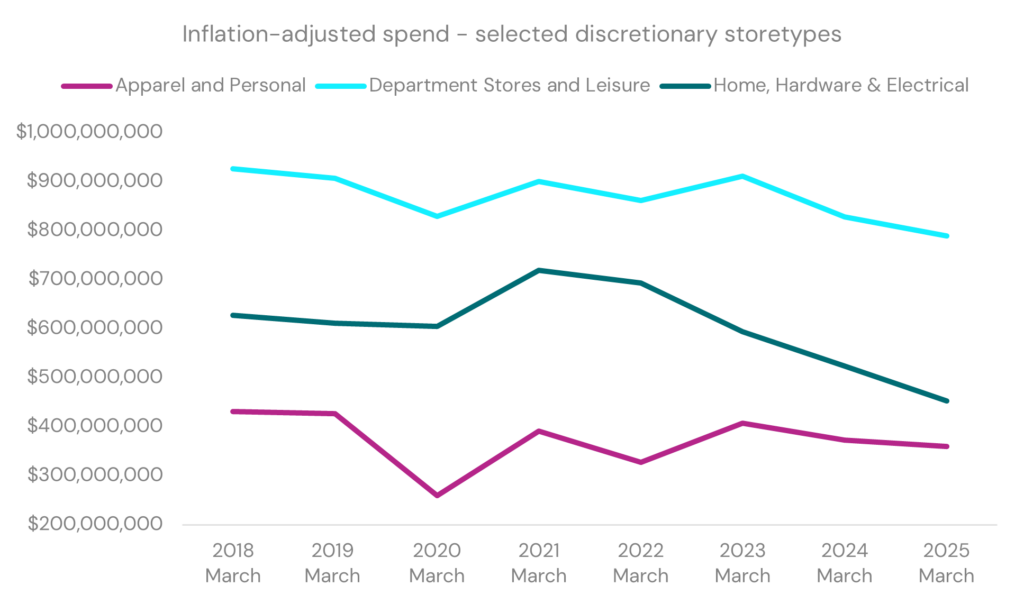

These trends are evident across many storetypes.

Three of our core discretionary retail storetypes have experienced a strong drop in inflation-adjusted spending. For each of these storetypes, the decline from 2023 has been much more evident, which further reflects the challenging economic environment. In tough times, consumers often withdraw on discretionary spending and these storetypes are hardest hit. Especially the Home, Hardware & Electrical sector.

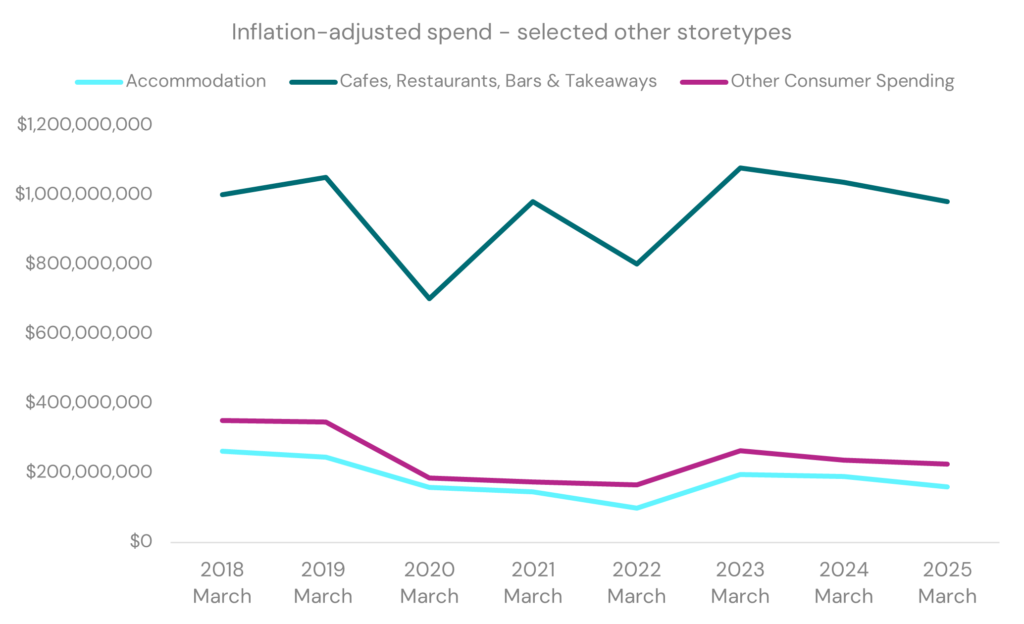

The same can be said when comparing Accommodation to Other Consumer Spending which contains many tourism-related ANZSICs. There was an immediate response to the borders reopening, but they just never returned to the values seen pre-pandemic. Cafes, Restaurants, Bars & Takeaways are holding their own, although charting a decline since 2023, not quite as impactful as the many high-profile closures of hospitality businesses in the media might seem to suggest.

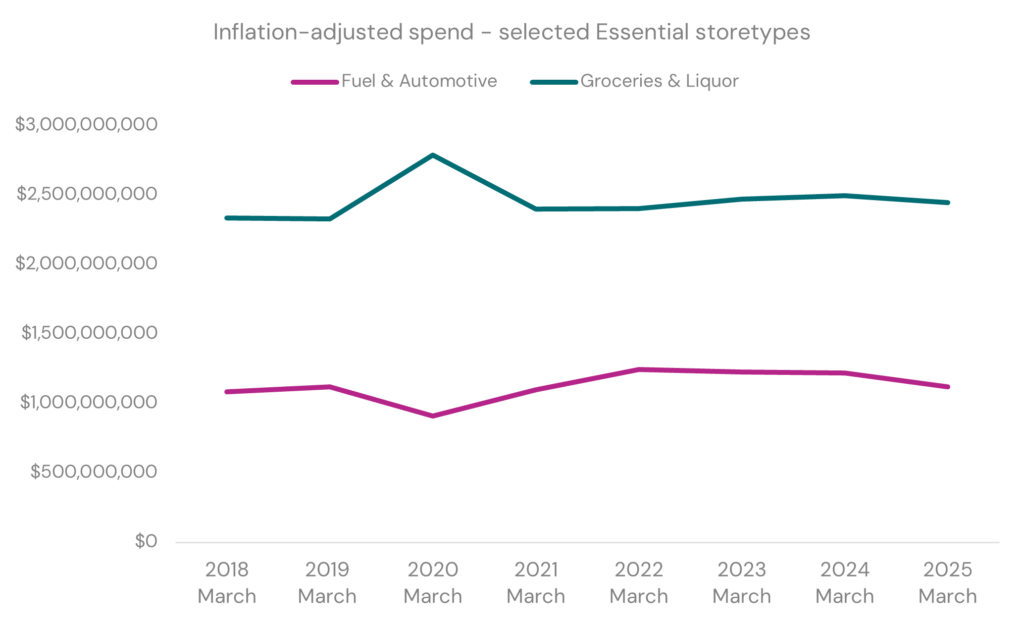

Groceries & Liquor and Fuel & Automotive, core requirements in many consumers’ budgets, are seemingly less affected post-pandemic. Despite widespread inflation, Groceries & Liquor have been charting a small but steady increase in spend, suggesting a slight increase in demand and preference for this industry. Fuel & Automotive has experienced a decline since 2023, like many of the discretionary storetypes, although much more gently.

While non-adjusted spending is up for most industries, the analysis above reflects that consumers are generally spending less in the retail sector. When adjusting for inflation, we see that consumer spending has dropped since pre-Covid times, and those drops are even more pronounced since 2023 when NZ’s economic hardship became evident.

We hope that the worst of it is nearly over and our friends in the retail sector can enjoy better times in the near future.