- Consumer spending in May 2024 grew 2.9% from May 2023, while transaction volumes grew 2.2%.

- The West Coast Region was the best performing location, enjoying a 9.9% increase in spending.

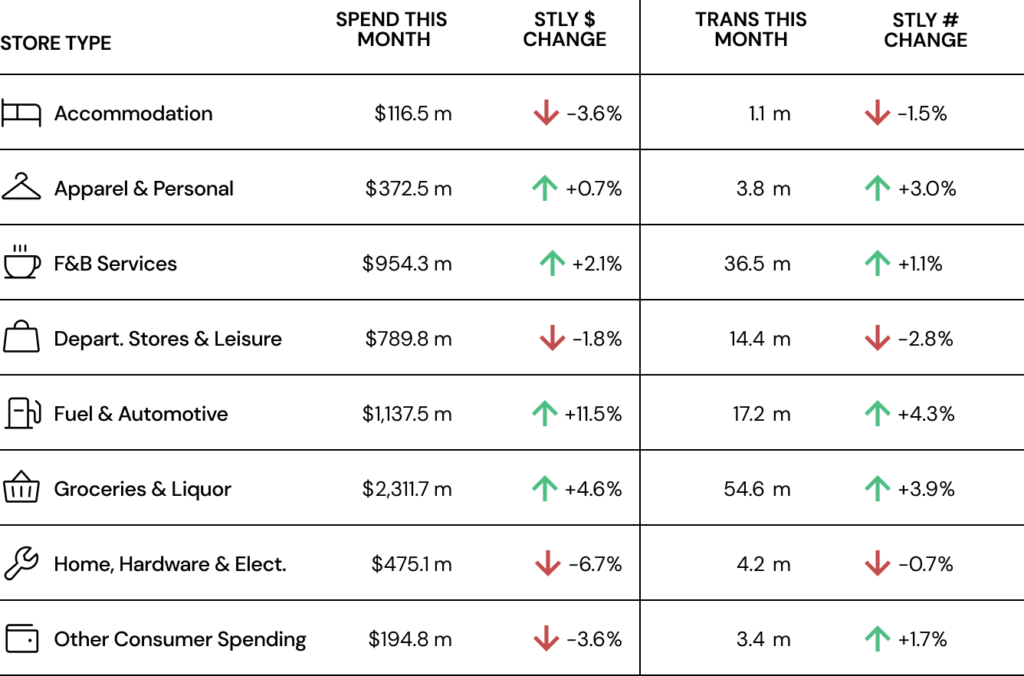

- Fuel & Automotive was the highest performing storetype, growing by 11.5%, while Home, Hardware & Electrical was the worst performing, down 6.7%.

- Consumer spending in May 2024 was up 19.6% on May 2019 (pre-pandemic).

Highlights for Autumn 2024:

- Spend in Autumn (March – May) 2024 grew 1.3% from 2023.

- The West Coast Region was the highest performing location, with a 6.8% increase.

- Fuel & Automotive was the highest performing storetype, growing by 8.3%.

Autumn 2024

Consumer spending over the Autumn months in New Zealand grew by a lean 1.3% from the previous autumn, with the month of May fairing slightly better, up 2.8%. The modest growth reflecting the fiscally tight period the economy is in.

Fuel & Automotive continued to be the strongest performing storetype, seeing spending increase by 8.3% from the previous autumn and 11.5% in May. While fuel prices play a part in this, overall transaction volumes also rose, suggesting a higher consumption of fuel also. International visitors drove the increase in total spend experienced this autumn, by spending up 15.7%. Visitors from the Republic of Korea is the last of the top ten visitor spend in New Zealand this autumn, but generated the highest change in spend, up 56.3%.

Best Performer: West Coast

The West Coast region was the best performing region, with spend up 6.8% over the Autumn period. This positive performance was aided by the growth in spend by both International and Domestic visitors at 14.5% and 5.5% respectively, whereas locals dropped spend by -2.0%. In line with national trends, the fuel & automotive sector was the strongest driver of this, up 14.5% over the 3-month period.

West Coast Region, with its natural scenery and spaced-out centres, supports a driving itinerary for visitors. This is reinforced by the 25.2% increase in spend by Internationals on Fuel & Automotive, followed by Domestics who increased spend by 16.7%.