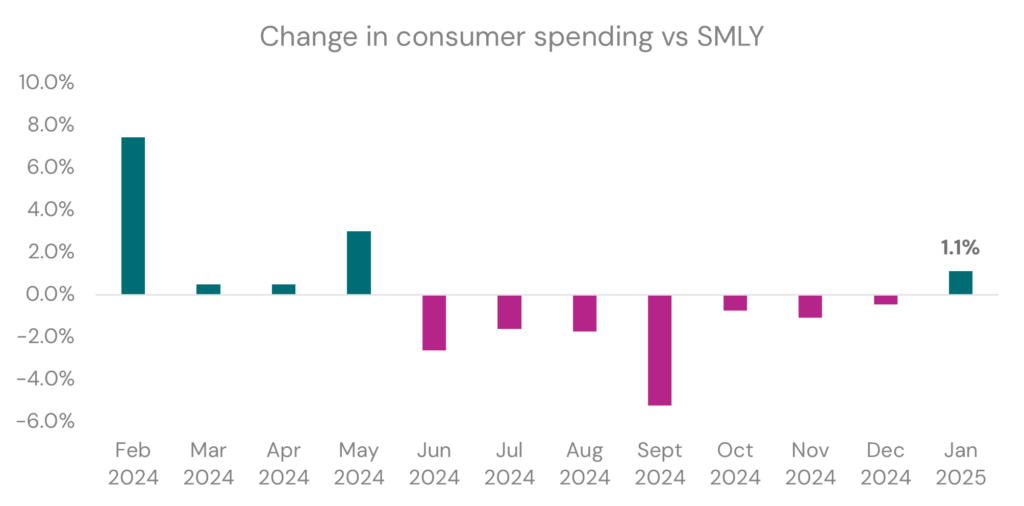

Consumer spending rose in January, up 1.1% from last year, finally ending the trend of month on month negative growth. As it turns out, international visitors were largely to thank as they increased their spend by 17.0%, whereas New Zealand cardholders maintained the same spend levels, or -0.003% to be exact.

Key insights for January 2025

• Consumer spending grew by 1.1% while transactions grew a similar amount, up 1.0%, the first time since May 2024, when the change in spend was higher than the change in transactions.

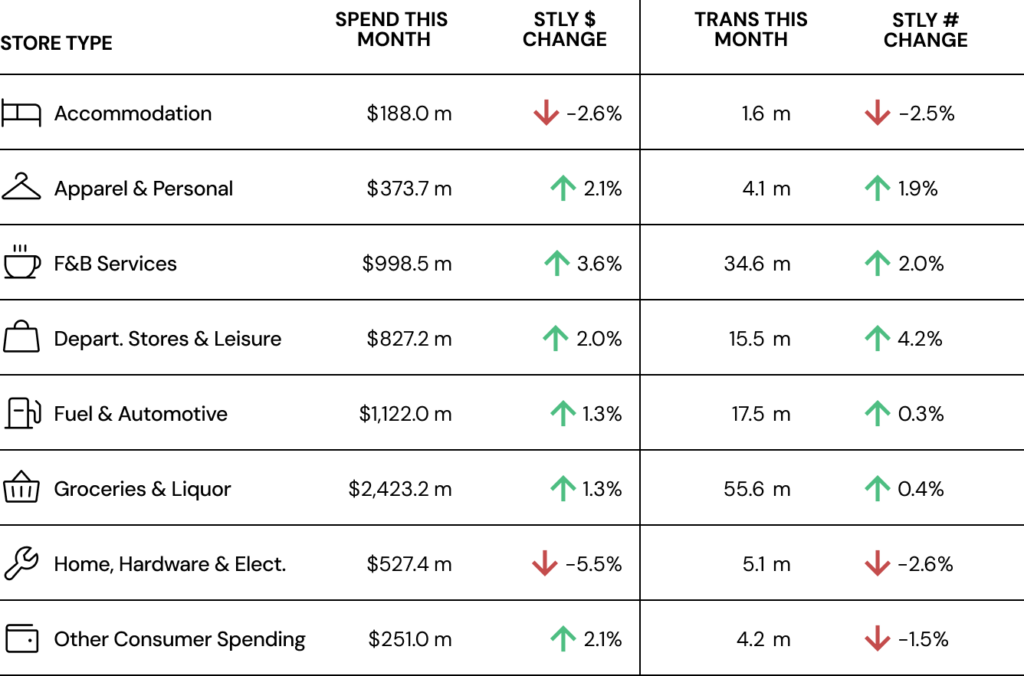

• Six of the eight storetypes monitored saw spend increase this January.

• Cafes, Restaurants, Bars & Takeaways led the charge with spend up 3.6% on last January. Transactions for the F&B sector was also up 2.0%, reflecting perhaps some belated merry-making after last month’s dismal drop in spend.

• Home, Hardware & Electrical was at the other end of the chain, with a drop in spend of 5.5%, and a drop in transactions of 2.6%.

• The South Island took the top 3 spots of growth this January, with West Coast leading the charge at 6.4%, followed by Southland at 5.4%, and the Otago Region at 3.7%.

• Compared to January 2019 (pre-pandemic), consumer spending was up 23.0%.

The Need to Woo Australian Visitors

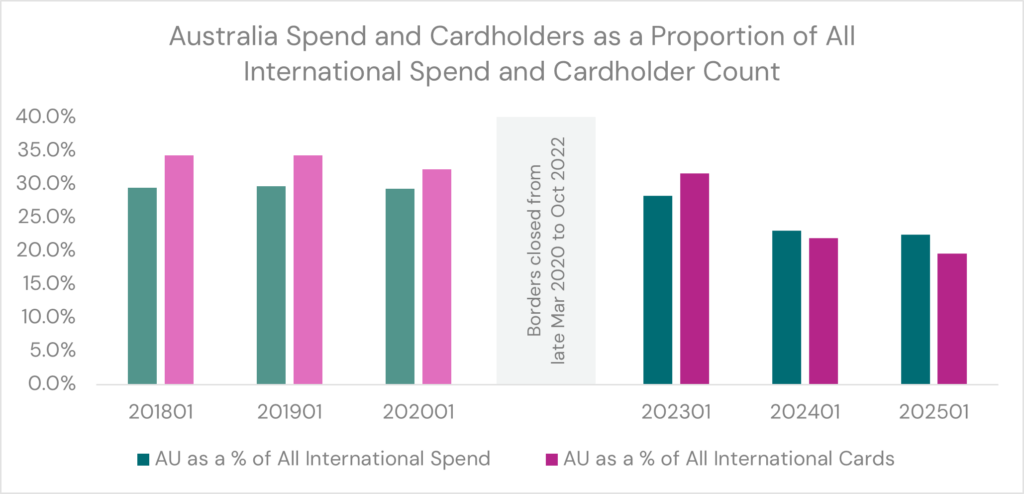

With the government targeting international tourism to drive our short-term economic growth, there’s been a flurry of tourism announcements. Earlier this week, Tourism New Zealand launched their “Everyone must go” campaign, targeting Aussies to New Zealand. The industry reports that their arrivals have yet to reach pre-pandemic levels hence the drive to win them back.

The cause for concern around Australia visitors seems justified. Spend in January by Australian visitors as a proportion of total international spend averaged 29.5% in the 3 years pre-pandemic and averaged 24.6% in the 3 years post-pandemic (green columns in Chart 1). Regardless of looking at it from a spend or cardholder count perspective (our proxy for people; red columns in Chart 1), Australians are losing their share of the New Zealand inbound market.

Chart 1: Australian Spend and Cardholder Count as a Proportion of all International Visitor Spend and Cardholder Count in January of the stated years.

Looking at the month of January in the pre-pandemic years, Australians were already starting to show signs of slowing down, with spend down an average 0.3%. During those pre-pandemic January(s), spend was down across Accommodation and Other Consumer Spending which includes many tourism-related ANZSICs.

Fast-forward to post-pandemic, the January(s) since 2023 saw an even larger drop in average spend, down 10.6%. No category was spared, with Groceries & Liquor being the least affected (-2.5%) and Accommodation the worst (-22.3%).

Comparing 2025 January with 2019 January, it looked more dire, with spend down 24.5%. This time, Groceries & Liquor was the only category that registered an increase in spend, up 0.8%. That could well be the effect of the cost of living we face today but that’s another story for another day. The tourism-related categories were the worst hit with Other Consumer Spending down 54.3% and Accommodation down 43.2%.

It is justified we get serious about wooing the Aussies back, and with some urgency.

Hey Aussie friends! Everyone must go (to New Zealand)!