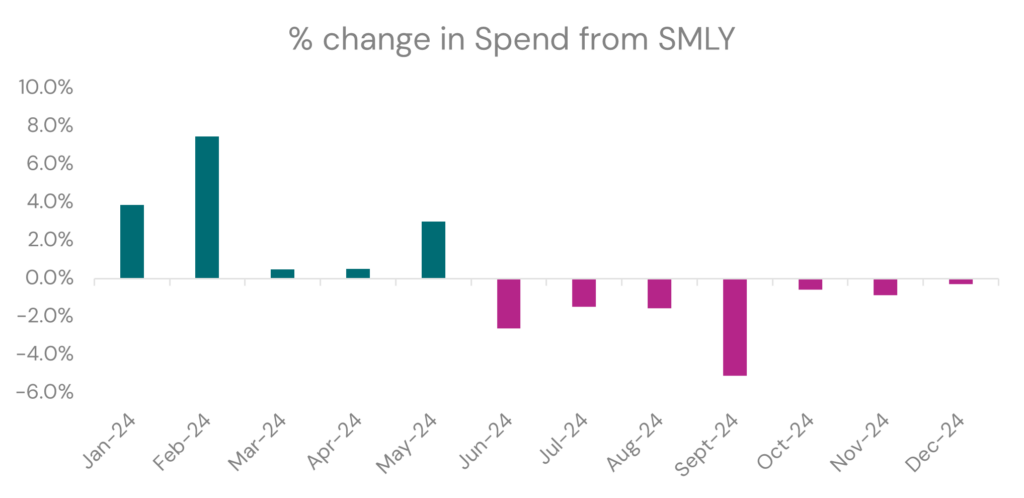

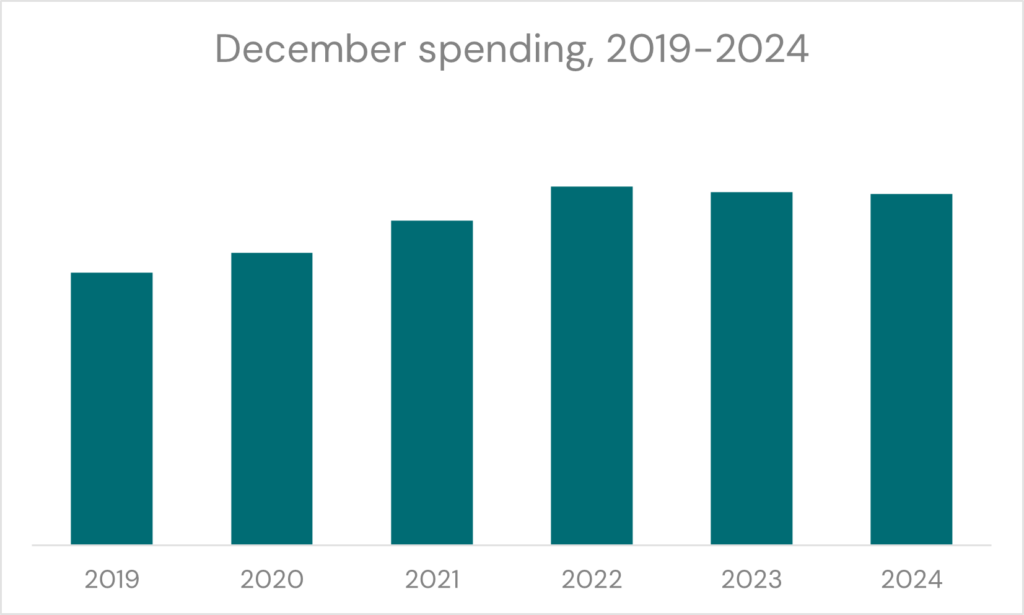

Consumer spending was down -0.3% from December 2023. Despite the month featuring key retail events like the buying spree in the lead up to Christmas, and Boxing Day, this marks our 7th consecutive month in decline.

This December is also the lowest of our post lockdown Decembers, with the highest in 2022 when New Zealand emerged from Covid lockdowns and our borders were officially opened in time for our peak tourism period.

Key insights for December 2024

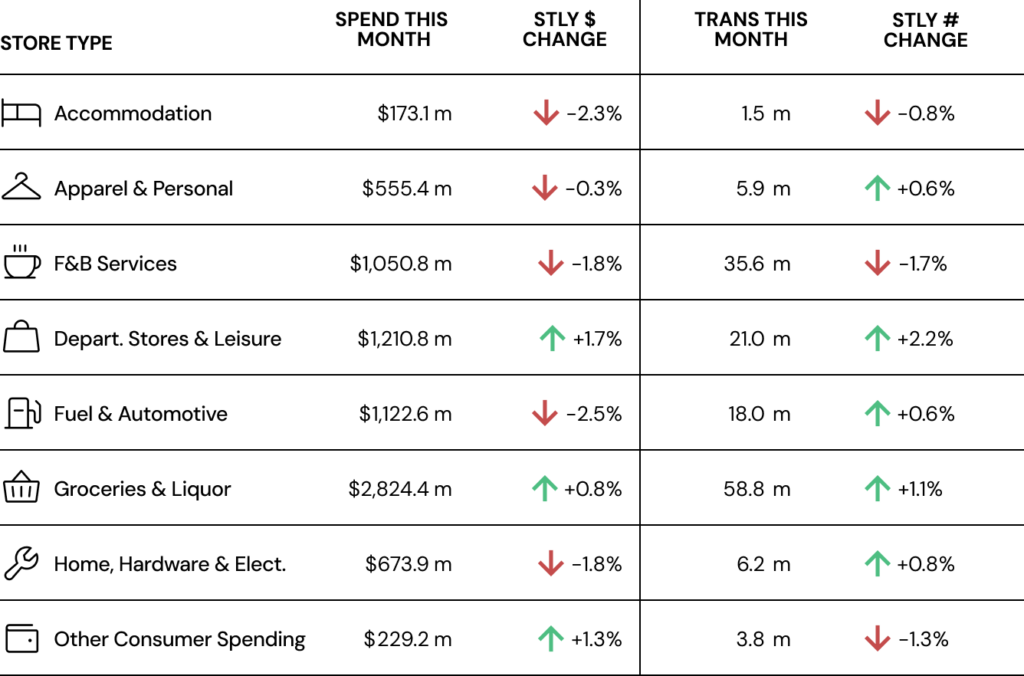

- Consumer spending dropped -0.3%, while transactions increased +0.4% when compared to December 2023.

- Department Stores & Leisure took the podium this month for the highest increase in spend, at +1.7%. Just 3 of 8 measured storetypes experienced growth.

- Spend on F&B Services was down -1.8%. Transactions was also down, marginally less at -1.7%.

December tends to be characterised by a lot of merry making with Christmas work-dos and end of year get-togethers. It is therefore surprising and sad, to see that the usual injection December may bring to F&B Services hasn’t eventuated.

While there were certain pockets of the month that brought people out, for the most part we reined in our spending this year, yet another sign of the tough-economic times we are currently in. - Eight of the 16 regions saw spend rise this month. Leading the way was the West Coast Region at an enviable 5.3% from the same month last year.

- Compared to December 2019 (pre-pandemic), consumer spending was +16.0%.

An active Christmas period

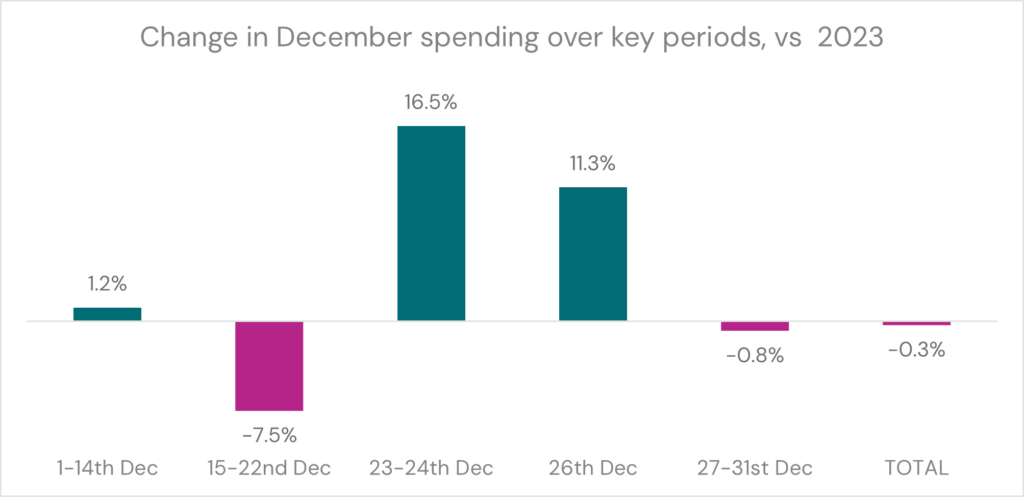

The specific day of the week that Christmas falls on often has an impact on pre-Christmas shopping trends. Christmas Day fell on a Wednesday this year, compared to a Monday last year. As a result, Christmas shoppers increasingly left it late this year, with spending over the 23rd-24th December up 16.5% on the 2023 comparative dates. These two dates accounted for 9.1% of our total December spending this year (up from 7.8% last year).

As the weather was pretty uninspiring in many areas, it looks as though consumers flocked to the shops on Boxing Day, with spending up 11.3% on Boxing Day last year.

Reserved activity outside Christmas

While the days immediately before and after Christmas Day experienced a flurry of retail activity, the rest of the month was rather subdued. The first two weeks of the month were flat, as was the dates following Boxing Day. Spending from the 15th-22nd of December was down 7.5%, further reflecting many consumers’ preference to leaving Christmas shopping to the last minute.