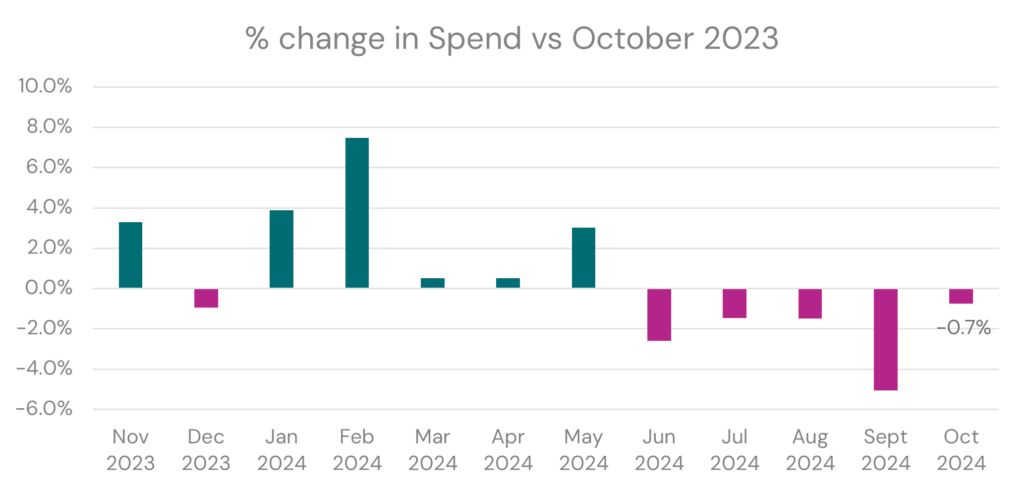

At the risk of sounding like a broken record, spend in New Zealand saw a fifth consecutive month of decline (see chart below) when compared to the same month last year.

On the upside, it is the smallest drop over that period, at -0.7%.

Is this the glimmer of hope that many retailers are hoping for? That consumers are opening their wallets with a little less trepidation?

Key insights for October 2024

- Consumer spending dropped -0.7% but transaction volumes increased +1.3% when compared to October 2023.

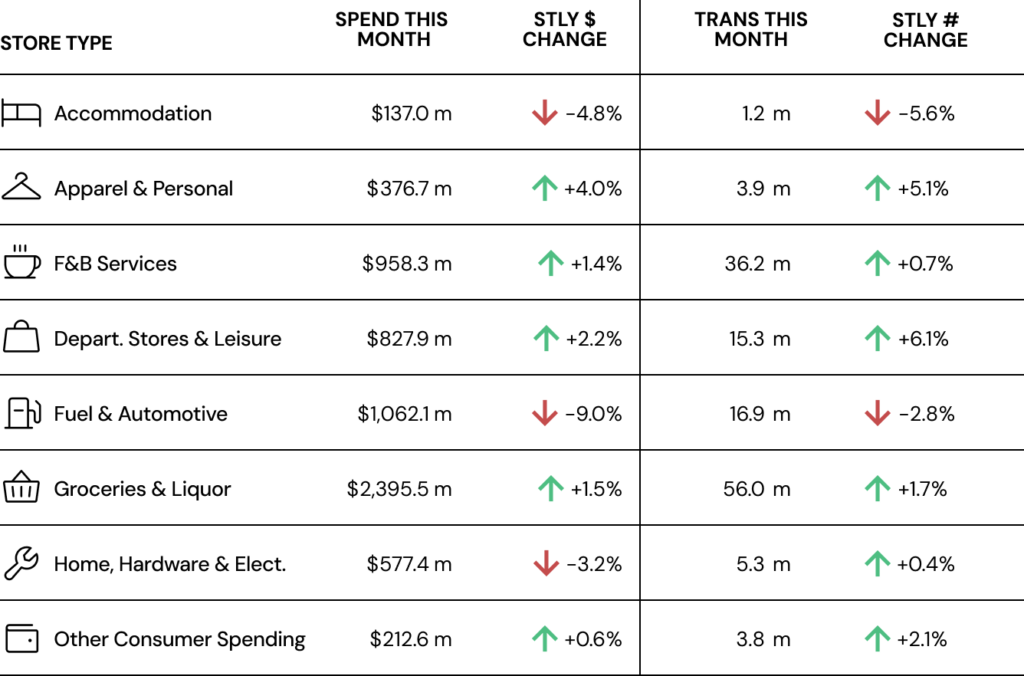

- For the first time in a long time, non-essentials, Apparel & Personal, tops the chart of highest growth this month, up +4.0%.

- Northland Region saw the highest growth in spend, up 1.7%.

- Compared to October 2019 (pre-pandemic), consumer spending was up 18.4%.

While the Groceries & Liquor storetype has been topping the charts over the last few months, we now see strong results for some of the more discretionary sectors.

This month, Apparel & Personal led the way, with spending up +4.0% and with Department Stores & Leisure not far behind (+2.2%). Even the long-suffering hospitality sector saw some growth (Food and Beverage Services, up +1.4%).

Fingers crossed with the retail season of Black Friday through to Boxing Day, the peak tourism season, and warmer days ahead, that retailers of all storetypes will indeed be in for better times ahead. Afterall, what goes down, must come up. Right?

On the cusp of better days ahead.

October is often the beginning of fun times ahead for both consumers and retailers. We have the October school holidays and Labour weekend, and from wherein the tourism and retail sectors believe things pick up. With that in mind, let’s plough into the data…

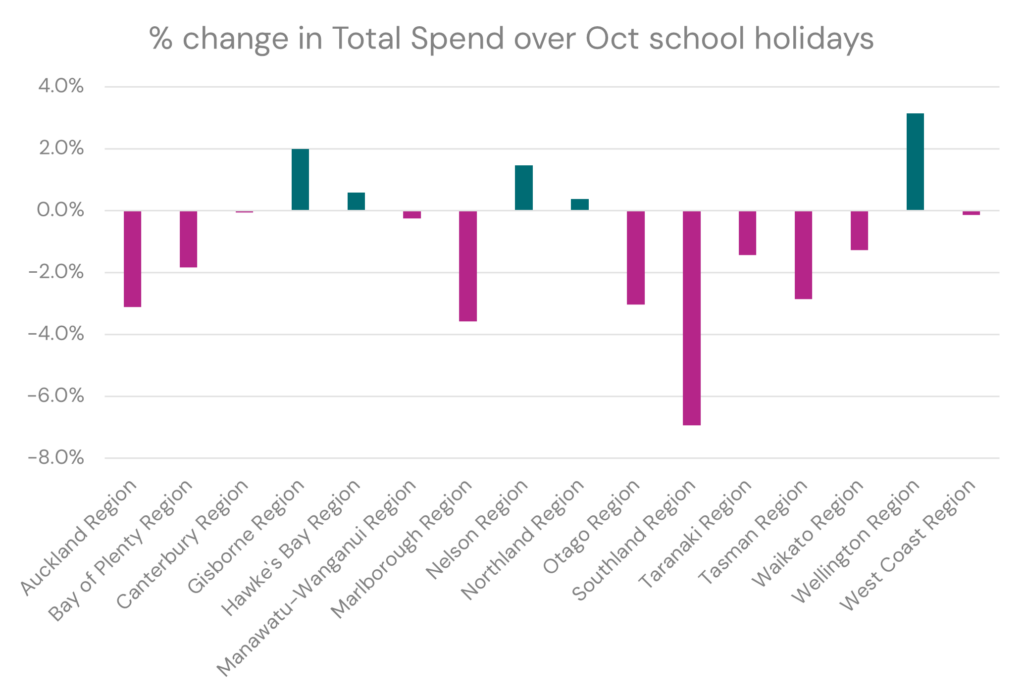

October school holidays

October school holidays took place from Saturday 28th September to Sunday 13th October. Overall, consumer spending was down 1.3% in that period, largely in line with the monthly result for October.

Wellington Region (+3.1%) led the growth, followed by Gisborne (+2.0%), Nelson (+1.5%), Hawke’s Bay (0.6%), and Northland (0.4%) as the only regions that experienced growth over the same holiday period last year (see chart below).

In the Wellington Region, spend by domestic visitors was a moderate 2.8% increase from the same time last year. Spend by international visitor, at 34.5%, was what drove that spend increase!

It therefore looks like Wellington’s spend increase was less to do with the school holidays, and more that international tourism has picked up. Coincidentally, the Diamond Princess with its 2,670+ international passengers visited Wellington on Sunday 13th October, and generated 77.5% more spend on that day than the same time last year.

Labour Day

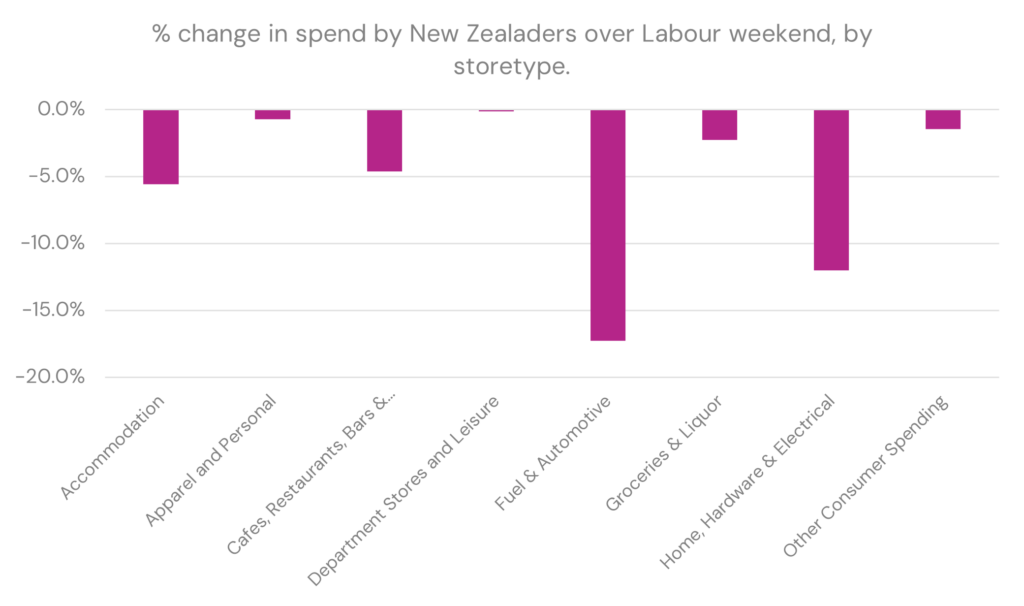

Labour Day was created to celebrate the fight for an 8-hour day, for work life balance (NZ History). This Labour weekend, it seems we took this rest literally. When compared to Labour weekend in 2023, spend was down -4.7% across the board.

Traditionally, this has been an active retail weekend particularly in the home and hardware sector, as many use this weekend to prep their gardens or do some home DIY. However, it doesn’t look to be so as we see in the chart below, with spending across all storetypes down over Labour Weekend.

While consumer spending may be slow to recover from a strained winter period, this month’s spend is a nod in the right direction. With Black Friday featuring prominently in November, we will be eagerly awaiting the results and will look forward to sharing it with you here.