Black Friday and Boxing Day are two of the biggest, and most marketed days in the New Zealand retail calendar, with both typically promoting a range of compelling discounts and promotions for consumers.

Whilst Boxing Day sales have been a longstanding tradition in New Zealand, Black Friday wasn’t always so commonplace. Black Friday originated in the United States but quickly gained popularity in New Zealand due to its timing (last Friday in November), which offers consumers an opportunity to lock in Christmas presents and general household items at a discount.

We looked into consumer behaviour over each day to determine which date drives more consumer spending and any notable trends within.

In 2023, Black Friday ranked as the 9th largest day of consumer spending across traditional retail categories, with 60.8% more spending than the average day. Meanwhile, Boxing Day was slightly behind, in 14th place, 10.0% lower than Black Friday but still up 46.2% compared to the average day. For those wondering which other days could possibly beat those two major retail events? Well, the days leading up to Christmas Day featured heavily in the top 10 days of retail.

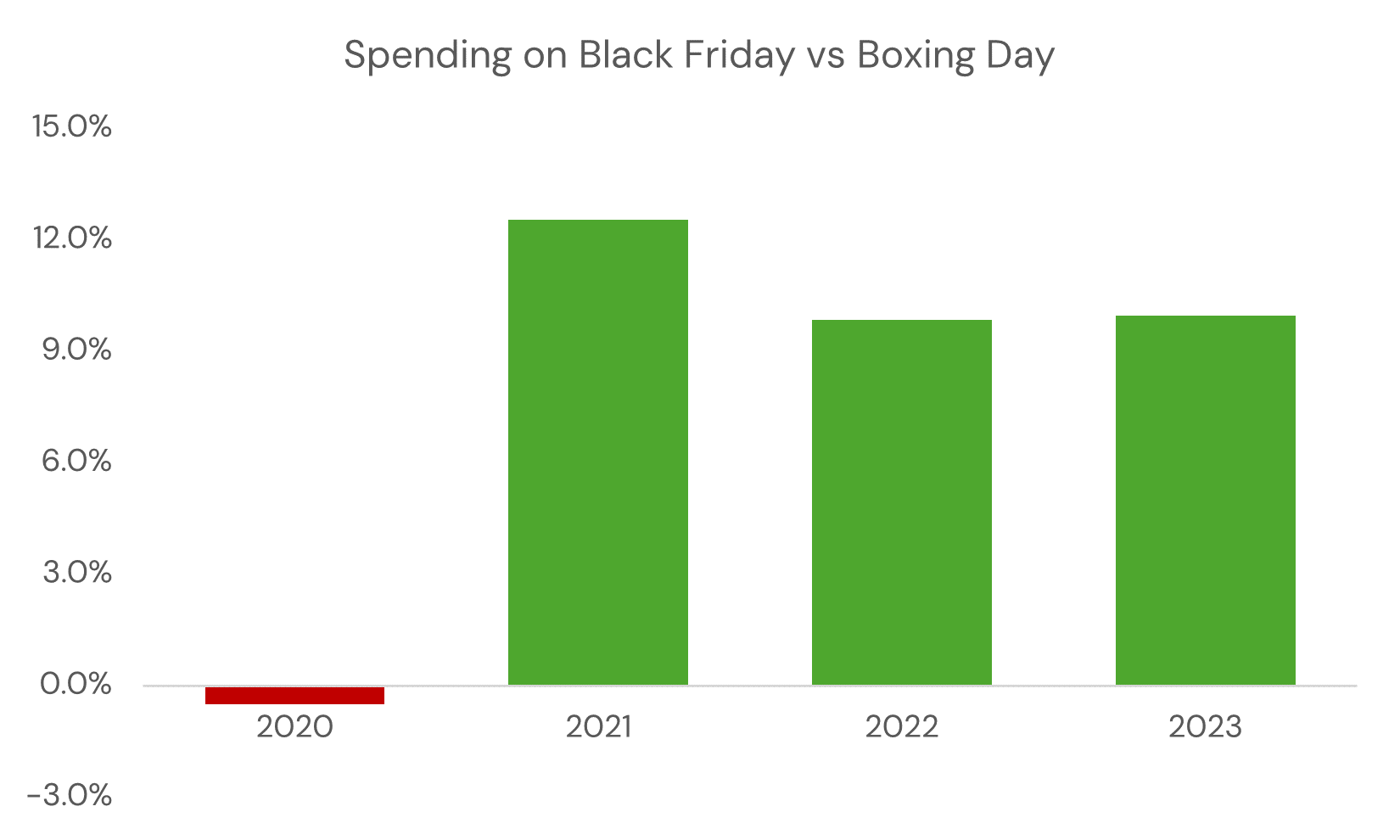

We reviewed consumer spending data from the previous three years to determine whether the 2023 result was an outlier. Apart from 2020, when Boxing Day and Black Friday sales were very similar, spending on Black Friday has consistently been higher as illustrated by the chart below.

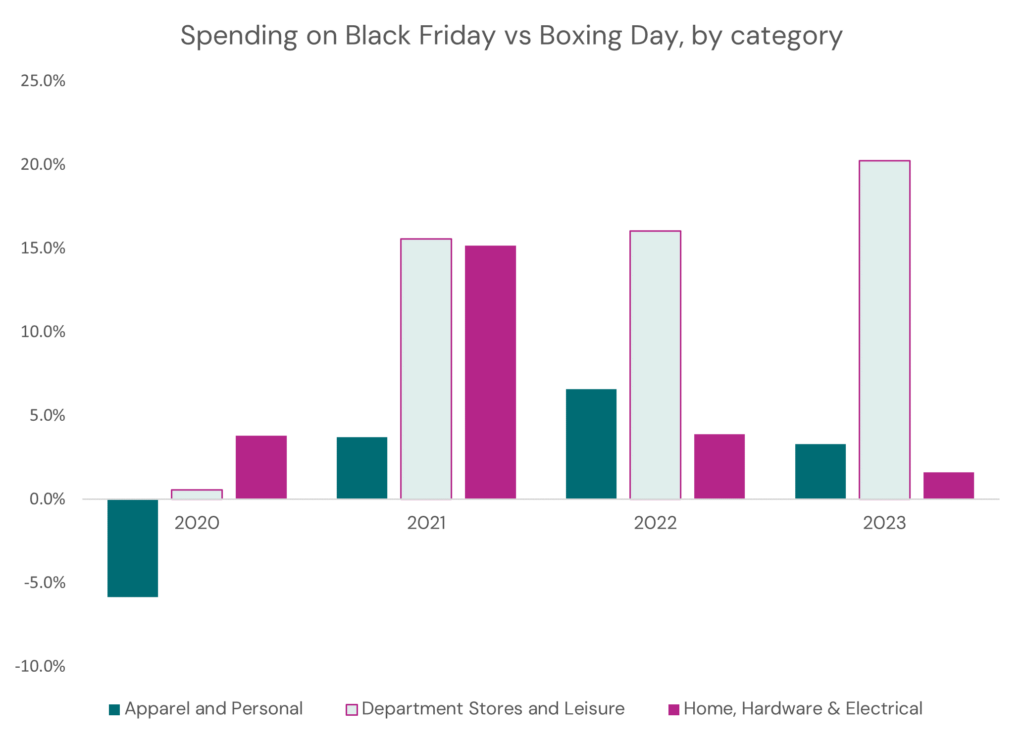

As part of this analysis, we subdivided traditional retail into three categories of similar quantum to further understand the drivers of Black Friday’s strong results.

The Department Stores and Leisure grouping (consisting of department stores, sports/camping equipment, entertainment/books, pharmacies, and more) is the notable winner. Spending in this grouping on Black Friday 2023 was 20.2% higher than on Boxing Day and has been at least 15% higher over the last three years as illustrated below. The other two groupings have been much more on par with Boxing Day over the last two years.

The Department Stores and Leisure grouping consists of many retail types associated with gift purchases (compared to Apparel and Personal, which is more related to oneself; and Home, Hardware & Electrical, which is more related to one’s living space), suggesting a key psychological driver to Black Friday sales is stocking up on gift purchases.

Despite the increasing popularity of Black Friday, the people who do head out on Boxing Day are there to make it count. Shoppers over Boxing Day have a higher average transaction value in all areas other than Apparel & Personal as illustrated in the chart below. This suggests that most businesses are providing better deals on Black Friday and attracting people in droves.

Despite Black Friday being a weekday, a month out from Christmas Day, the popularity of the day is evident in the volumes we are spending. With many retailers choosing to bring their sales forward, consumers are likely taking this early opportunity to stock up on early Christmas presents and fill out their wardrobes and homes, leaving Boxing Day as the second option for many bargain hunters.